IS-LM model: Difference between revisions

imported>Sylvain Catherine |

imported>Sylvain Catherine (→Limits: footnotes) |

||

| Line 160: | Line 160: | ||

*There is only one interest rate, while monetary authorities must deal with different interest rates. | *There is only one interest rate, while monetary authorities must deal with different interest rates. | ||

*the model describes an economy under [[autarky]]. | *the model describes an economy under [[autarky]]. | ||

==References== | |||

<references/> | |||

Revision as of 09:49, 14 September 2008

The IS/LM model is a mathematical model developed by John Hicks and Alvin Hansen in order to describe macroeconomic ideas proposed by John Maynard Keynes in his General Theory of Employment, Interest and Money. The model describes an economy under autarky (a closed economy), while the more sophisticated Mundell-Fleming model takes into account international exchanges.

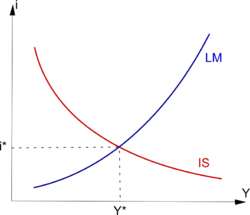

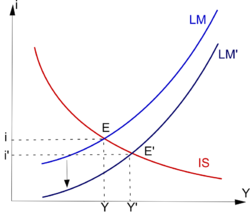

The model presents simultaneously two curves, IS and LM, in a graph in which the horizontal axis represents national income (Y) and the vertical axis represents the interest rate (i).

- IS illustrates the relationship between the level of income (Y) and the interest rate (i) in the real sector (goods and services). Lower is the interest rate higher is investment and thus the income.

- LM describes the relationship between the level of income and the interest rate in the monetary market. Higher is the level of income, higher is the need for money and thus the interest rate.

The intersection of the curves represents the general equilibrium for which both relationships are verified, that is to say the actual equilibrium of the economy.

The IS/LM model is the most common macroeconomic model. It enables to understand easily the relationships between the real sector and the monetary market as well as the effects of monetary and fiscal policies. Yet its neglect of anticipations makes it obsolete to determine the actual efficiency of macroeconomic policies.

History

Creation and rise

During the great depression, economists tried to find solutions to economic problems that classical economics seemed unable to explain. In his General Theory, Keynes tried to represent economic agents with simple rules. The consumption was simply linked to the income via a propensity to consume; investments were linked to the interest rates. On the monetary side, he gave up the classical concept of money neutrality and developed the assumption that money can be demanded for itself (speculative demand), depending on expectations about interest rates, and not only as a tool for transactions. Eventually, he argued that prices were rigid in a short-term view, while classical economics considered prices as the key adjustment variable. Keynes demonstrates that under those assumptions, monetary and fiscal authorities could have a powerful influence on economic activity.

In 1937, John Hicks built the IS-LM model in order to translate those ideas in neoclassical terms. Some Keynesians saw his attempt as a simplification of Keynes vision but Keynes approved it.

An important extension of the IS-LM model was built by Robert Mundell (1963) and Marcus Fleming (1962) in the 1960's. The Mundell-Fleming model describes a small open economy with one more curve representing equilibriums of international exchanges.

Decline

During the 1950’s and 1960’s microeconomic investigations on consumption and investment gave a better understanding of the IS slope. Milton Friedman developed the idea that the consumption level of household’s was mainly determined by a long-term expectation a theory known as the permanent income hypothesis[1]. Franco Modigliani life-cycle theory demonstrated that consumption was also related to age. Those two theories denied short-term policies to have an important effect on consumption, and thus the effects of the spending multiplier.

Such criticisms of keynesian ideas were not always criticisms of the IS/LM model. In fact, economists like Milton Friedman used the IS/LM framework to confute Keynesian economics[2]. Yet Friedman rejected the paradigm of "general equilibrium" he viewed as characterized by "abstractness, generality, and mathematical elegance"[3]

The most severe criticisms of the IS/LM model came from the fact that it negligees private agents expectations. Modern macroeconomic models which take anticipations into accounts can provide results opposite to those of IS/LM. In fact, the model considers that short run is independent from long run. Yet expectations about the future have for example a direct impact on current wages which stimulates inflation and thus cancelled the positive effects of many macroeconomic policies described by the IS/LM model. In such cases, inflation remains the only effect and disturbs the coordination of private agents. The consequence of the rational expectations theory is that central banks of several industrial countries (the Federal Reserve and the European Central Bank for example) have been given independency and inflation control as their main objective.

Nowadays

Nowadays IS/LM model is an obsolete tool : its neglect of expectations makes it inefficient to implement an efficient economic policy. Yet, along with its Mundell-Fleming extension, it remains the most common macroeconomic model taught to undergraduate students because of its pedagogical qualities.

The model

Equilibriums in the real market : IS curve

“IS” stands for “investment and saving”. The IS curve represents all equilibriums for which total spending (consumption and investment) equals total output (income). This equation is equivalent to the equality between investment and saving, which is a basic accounting equation in a closed economy.

Investment is a decreasing function of interest rate. Indeed, the interest rate represents the opportunity cost of an investment. Higher is the interest rate, higher must be the return on investment. It implies that when the interest rate is high many investments whose profitability would be low are not undertaken.

I is a decreasing function of i, and so is Y. Then IS is a decreasing curve.

Equilibriums in the monetary market : LM curve

“LM” refers to “Liquidity preference and money supply”. The LM curve represents all equilibriums where demand equals supply on the monetary market.

According to Keynes, people hold liquidities for two reasons.

- Citizens need cash for every day life transactions and because of uncertainty (they are cautious). Keynes calls those needs “transactions demand for money”. It is positively related to income (Y).

- When people want to save they must choose between securities (financial markets) and money. Money can be considered as an asset among others and its price is the interest rate. Keynes suggests that when the interest rate seems too low, speculators expect it to rise and thus "buy" (by selling financial assets for example) or borrow money. On the contrary, when they think that the interest rate is too high, speculators expect it to drop and sell money (by buying financial assets for example).

So, according to Keynes, demand for money includes transactions demand (L1) and speculative demand (L2). In equilibrium we have the following relationship.

And since

then LM is a increasing curve.

General equilibrium

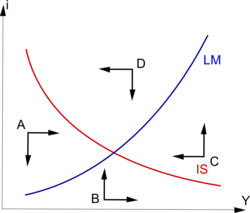

The general equilibrium is given by the intersection of IS and LM. The level of income and the interest rate can diverge from their equilibrium level only on a temporary basis. Indeed,

- If the interest rate and the income are situated at point A, then it means that in the goods and services market, supply is insufficient to balance demand. Prices will rise and so will production. It also means that demand is insufficient to balance supply on the monetary market which will make the interest rate fall.

- At point B, supply of goods and services is also insufficient and so is money supply. This combination implies a rise of both output and interest rate.

- At point C, supply exceeds demand in the real market, and then companies must reduce their output. The lack of money make interest rate rise.

- At point D, supply exceeds demand in both the real market and the monetary market. Both production and interest rate will drop.

Analysis of macroeconomic policies

According to Keynes, the labour market is not a market among others. The demand of labour (that is to say the demand of corporations for workers) is not always determined by the level of wages, but also by the aggregate demand (C+I=Y). During a recession, the aggregate demand may be insufficient to require all production factors (capital and labour). In this case, the economy can be in equilibrium with persisting unemployment. In such a situation, the State can stimulate the economy with macroeconomic policies without creating inflationary tensions.

It can be noted that Keynes suggests implementing such measures in case of recession, while keynesian economists have then defended those policies as permanent regulation.

Slope of the curves

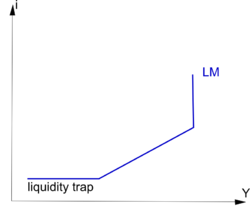

The efficiency of macroeconomic policies is directly affected by the slope of LM and IS. For example, a liquidity trap, which implies a flat LM curve, makes the monetary policy inefficient.

The liquidity trap occurs when interest rates would be so low that everyone would expect them to rise. In this case, an infinite speculative demand would actually make them reach a more realistic level. Keynes concludes that interest rates cannot fall under a certain level whatever the income Y. In this situation, LM is horizontal.

On the contrary, there is a level of interest rate for which speculators have lent all their money. There is no more saving to finance any expansion of the output. In this case, LM is vertical.

In John Hicks views, the vertical part of LM corresponds to the general equilibrium of classical economics, while the horizontal part was purely keynesian. In fact, the IS-LM model was an extent of the Walrasian theory which had forgotten some particular cases described by Keynes.

Between those extremes, expansions of the output are possible, but they increase the transactions demand for money and make interest rates rise.

The slope of IS reflects the interest rate elasticity of investment, and thus the impact of the variations of the interest rate on the output.

Fiscal policy

A more detailed model can be made in order to understand the effects of government spending. In this model, G represents governmental spending, T taxes, C consumption of private agents and I investment of private agents.

If C is considered as a proportion of Y noted c, we obtain:

The last equation implies that if the government increases its spending (G) without increasing tax revenues (T), by creating a deficit, then the effect on the national output will be 1/(1-c) times greater. For example, if c=0,8, then an increase of 1 of G implies an increase of 1/(1-0,8)=5 of Y. This mechanism is known as the spending multiplier.

In a few words, the government can change the level of Y by reducing or expanding the budget deficit.

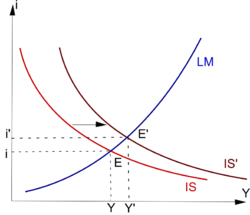

In the case of a expansionary fiscal policy, the government increases its purchases or reduces taxes, which creates a budget deficit and makes Y rise as explained before. This deficit shifts the IS curve to the right (Y rises). It results in a new general equilibrium (E'). The output Y has become Y' while the interest rate has risen from i to i'. By the way of higher interest rates, such a policy is said to crowd-out private investment. According to keynesian economics, this negative effect can be exceeded by the positive effect of the spending multiplier at the following conditions :

- The marginal propensity to consumption (c) is high. Higher is the marginal propensity to consumption, more important is the spending multiplier.

- the slope of the LM curve is low (important speculative demand for money). The importance of the speculative demand for money reduces the rise of interest rates linked to the expansion, and thus the crowding-out effect.

- and the slope of the IS curve is high (low interest rate elasticity of investment). Private investments are not very affected by the rise of interest rates.

- prices must be rigid.

- Some factors of production must be avaible.

A contractionary fiscal policy would have the opposite effects.

Monetary policy

The IS/LM model assumes that the monetary authority control the supply of money. If the supply of money is increased, then the price of money, i.e. the interest rate, will drop. A lower interest rate will stimulate investments and thus the output.

On the graph, an expansionary monetary policy makes LM shifts down (drop of the interest rate). Such a measure is particularly efficient under the following conditions:

- A low interest elasticity of the demand for money. In this case, an important decrease of the interest rate would be necessary if demand is to equal supply.

- A high interest elasticity of investment so that the fall of the interest rate has a large effect on the output.

- An important multiplier effect.

- prices must be rigid.

- Some factors of production are avaible.

A contractionary monetary policy would have the opposite effects.

Limits

According to free-market theorists, the flexibility of prices implies that the long term general equilibrium corresponds to a structural level of unemployment. It does not imply full employment, but means that unemployment is due to structural causes (imperfections of the labour market) and not to insufficient demand.

If the long term equilibrium corresponds to a situation of structural unemployment, then it is pointless to increase the output with macroeconomic measures, since all production factors available are already used. A higher level of output would imply a lack of production factors (workers or capital) which would provoke inflationary tensions. Under those assumptions,

- An expansionary monetary policy only creates inflation.

- An expansionary fiscal policy creates inflation and raise interest rates.

Mainstream economics now consider that private agent expectations about future inflation create immediately or at least rapidly an increase of wages and inflationary tensions. If prices are not as rigid as Keynes thought, then the IS/LM model looses a part of its interest.

In few words the main flaws of the model are that:

- rigidity of prices is a short term assumption, thus the model only explains short-term effects.

- effects of anticipations are not taken into account. Modern models that take anticipations into account shows, for example, that contractionary fiscal policies can increase the output, while the IS/LM model has an opposite conclusion. The effect of monetary policy also depends on anticipations.

Other limits are related to the simplicity of the model:

- Goods and services are merged into one unique market. This reduces the sharpness of the model since the actual situation can be very different from one market to another.

- There is only one interest rate, while monetary authorities must deal with different interest rates.

- the model describes an economy under autarky.

References

- ↑ Friedman, Milton (1957). A Theory of the Consumption Function. Princeton Univ Press.

- ↑ Bordo, Michael D. & Schwartz, Anna J. (2003), "IS-LM and Monetarism", National Bureau of Economic Research, p.18 [1]

- ↑ Milton Friedman (1949 (1953)), , "The Marshallian Demand Curve" in Essays in Positive Economics, Chicago: The University of Chicago Press, pp. 47-99.