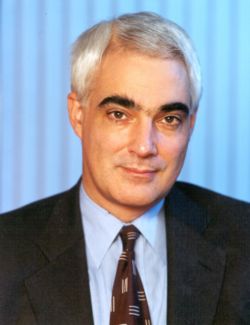

Alistair Darling

| Supplementary material: (i) links to contemporary reports ; (ii) notes on fiscal developments. |

Alistair Darling is a British Member of Parliament who served for 22 years in senior posts in opposition and in government between 1988 to 2010. In 2007 he succeeded Gordon Brown as Chancellor of the Exchequer. Shortly after he took office, the country experienced the first effects of the Great Recession and, in the following three years he was engaged in the fiscal management of the British economy during its most turbulent post-war period. After a brief spell as an opposition spokesman following his party's defeat in 2010, he retired from front-line politics but continued to serve as an active Member of Parliament.

Parliamentary career

After serving for 5 years as a Labour Party member of a local government Council, Alistair Darling was elected to Parliament at the age of 34. Within a year he joined the Opposition Home Affairs Team. In 1992 he was appointed Opposition Spokesman on the City and Financial Services, and in 1996 he was promoted to Shadow Chief Secretary to the Treasury. He became known as a moderniser and supporter of the movement within the Labour party that came to be known as New Labour and he became a close friend of Gordon Brown and a loyal supporter of Tony Blair. Following the Labour Party victory in the 1997 general election, Tony Blair appointed him to be Gordon Brown's deputy as Chief Secretary to the Treasury, and in 1998 he was promoted to the post of Secretary of State for Social Security. He was Secretary of State for Work and Pensions from June 2001 until May 2002, Secretary of State for Transport and Secretary of State for Scotland from 29 May 2002 to 5 May 2006, and Secretary of State for Trade and Industry from 5 May 2006 to 28 June 2007. When Tony Blair gave way to Gordon Brown as Prime Minister in 2007, Alistair Darling took Gordon Brown's place as Chancellor of the Exchequer in which post he remained until the Labour Government was defeated in the general election of 2010.

Chancellor of the Exchequer

- The economic developments during Alistair darling's chancellorship are described in the article on the Great Recession, and their effects upon the Government's finances are summarised in the addendum to this article

When Alastair Darling took over as Chancellor of the Exchequer in June 2007, some banks were beginning to suffer the effects of the subprime mortgage crisis, but the economy was continuing to grow at an above-trend rate. Later in that year, however, commodity price increases were beginning to affect growth, and the banking crisis was getting worse. In his November pre-budget report, Alistair Darling warned that a continuation of the banking crisis could reduce the rate of further growth[2]. By the middle of 2008, his fears were realised, and the economy was suffering from the effects of a major international financial crisis which he described in an interview as arguably the worst in 60 years"[3]. (That statement was attacked by the Shadow Chancellor as an admission of the Government's failings and a contradiction of reassuring statements by Gordon Brown[4]).

In the October 2008, there was a major intensification of the financial crisis, triggered by the previous month's collapse of the United States Lehman Brothers investment bank. Alistair Darling and Gordon Brown responded with a rescue package for British banks [5], and an international campaign[6][7] to persuade other governments to adopt similar measures in support their banks. During the following months, the British example was followed by other European countries [8] and similar measures were adopted by the United States. Those actions were followed by stabilisation of the financial system, but many British banks continued to suffer serious financial difficulties. A programme of additional support for the banks was adopted and by April 2009, five of the nine largest British banks had been taken partly or wholly into public ownership - in addition to the 2007 nationalisation of Northern Rock.

In November 2008, Alistair Darling announced a fiscal stimulus amounting to 1.5 per cent of GDP, including a temporary 2½ percentage points reduction in value-added tax and a bringing forward of £3 billion of capital investment[9]. His announcement had a mixed reception: it was called deceitful by the Shadow Chancellor[10] and "crass" by the German Finance Minister[11], but was subsequently described as successful by the International Monetary Fund[12]. There were responses to criticisms of the tax reduction by the Institute for Fiscal Studies [13] and the Centre for Economics and Business Research [14]

The growth of output resumed in the 4th quarter of 2009, and attention turned to the problem of reducing the, by then inflated budget deficit. Alistair Darling had inherited from Gordon Brown a deficit of 2.7 per cent of national income (which was above the OECD average, but lower than the deficit that Gordon Brown had inherited from his predecessor[15]), and ry the end of 2009 the deficit had grown to nearly 12 per cent. Of that total, less than 2 per cent was the result of Alistair Darling's fiscal policy actions: the remainder being due the recessionary operation of the economy's automatic stabilisers. The Institute for Fiscal Studies estimates the structural deficit - which is the portion of the deficit that is expected to persist after recessionary influences have ceased - to be about 6 per cent of national income. Recognising that the continuation of that magnitude of deficit would be unsustainable, the government launched the Fiscal Responsibility Act[16] - imposing upon itself a commitment to reduce it by half by the financial year ending 2014, and to make continuing reductions thereafter.

Retirement

Following the 2010 election, Alistair Darling served as the opposition's Shadow Chancellor until October 2010, when he retired from the Shadow Cabinet.

Personal history

References

- ↑ Office of Public Sector Information, UK.

- ↑ 2007 Pre-Budget Report and Comprehensive Spending Review statement to the House of Commons, delivered by the Rt Hon Alistair Darling MP, Chancellor of the Exchequer, 9 October 2007

- ↑ Guardian: 'Economy at 60-year low, says Darling. And it will get worse'. 30th August 2008.

- ↑ BBC News: 'Darling defends economy warning'. 30th August 2008.

- ↑ Rescue plan for UK banks unveiled, BBC News, 8 October 2008

- ↑ Paul Krugman: Gordon Does Good, October 12, 2008

- ↑ Andrew Rawnsley: The weekend Gordon Brown saved the banks from the abyss, The Guardian, 21 February 2010

- ↑ Lucia Quaglia: The ‘British Plan’ as a Pace-Setter: The Europeanization of Banking Rescue Plans in the EU?, Wiley Online Library, 20 October 2009

- ↑ Pre-Budget Report 2008, National Archives, 24 November 2008

- ↑ Osborne slams 'tax timebomb' plan, BBC News, 24 November 2008

- ↑ VAT cut is “crass Keynesianism”: The latest view from the German government, Financial Times, December 10, 2008

- ↑ United Kingdom – 2009 Article IV Consultation. Concluding Statement of the Mission, International Monetary Fund, May 20, 2009

- ↑ Thomas Crossley, Hamish Low, and Matthew Wakefield: The Economics of a Temporary VAT Cut, Institute for Fiscal Studies, January 2009

- ↑ Dan Milmo: Darling's VAT cut worked, says economics consultancy, guardian.co.uk, 12 April 2009

- ↑ Robert Chote, Carl Emmerson and Gemma Tetlow: Green Budget 2008, Institute for Fiscal Studies, March 2008

- ↑ Fiscal Responsibility Act, Stationery Office, February 2010