User:Janos Abel/sandbox/forBE: Difference between revisions

imported>Janos Abel mNo edit summary |

imported>Janos Abel |

||

| Line 36: | Line 36: | ||

[[Image:manyFaiths.jpg]] | [[Image:manyFaiths.jpg]] | ||

(Courtesy of the Mall Area Religious Council (MARC), | |||

Mall of America, Bloomington, USA)'' | Mall of America, Bloomington, USA) '''Hello Rodney :-)''' | ||

Revision as of 14:33, 25 April 2007

Illustrated version of BE

Binary economics is the expression of a new paradigm or new understanding of reality. It creates a new economics; a new politics; a new justice and a new morality. In its economics aspect, binary economics is a market economics whose markets work for everybody rather than just a few; and it upholds private property but private property, again, for everybody rather than just a few. A summary might be – a justice which creates efficiency and an efficiency which creates justice.

Binary economics is fundamentally different from all forms of conventional economics (be they expressions of right-wing, centrist or left-wing theory) and is now beginning to be taught in universities. The first such teaching is on the Islamic Economics and Finance postgraduate program at Trisakti University, Jakarta, Indonesia. Trisakti is famous as the birthplace of the 1998 Indonesian reformasi revolution. It is the biggest private university in Indonesia and second only to the main state university in prestige.

Background

Although elements of binary economics can be found elsewhere (e.g., Harold Moulton (1935) The Formation of Capital), the first clear formulation of the subject was by Louis Kelso and Mortimer Adler in their unhappily entitled book The Capitalist Manifesto (1958). The title is a Cold War nomenclature in opposition to communism but the book’s thinking can only be truly understood as being outside all left-wing and right-wing economics and politics – which is demonstrated by the attacks which were made. Thus, on the left, Soviet Pravda saw the book as “ramblings based on thinking along a dead end of history” – which was to prove egregious as communism was soon to collapse and binary economics is today increasingly being seen as the most modern economics and politics – while, on the right, Milton Friedman was nonplussed and could only conclude that binary economics must be “Marx stood on its head”. Very obviously, extreme left saw binary economics as extreme right; and hard right saw it as extreme left. And equally obviously, the puzzlement and confusion of Pravda and Friedman only serve to confirm that binary economics is outside both left-wing and right-wing paradigms.

Kelso and Adler (and, later, Patricia Hetter Kelso) were to continue to write ground-breaking books explaining how capital instruments provide an increasing percentage of the wealth and, crucially, how and why capital is narrowly owned in the modern industrial economy. Their analysis then has an important consequence easily understood by market theorists – if what increasingly produces a larger percentage of the wealth (capital) is narrowly owned, then a properly balanced economy (implementing Say’s Theorem (Law)) cannot come into being unless, on true free market and private property principles, capital becomes much more widely distributed. This is at the heart of the binary claim to create an efficiency which creates justice and vice versa.

Kelso and Hetter gave practical form to their thinking and proposed new binary share holdings which (with exception for research, maintenance and depreciation) would pay out their full capital earnings, be capable of being insured and, if loss occurred, would occasion no recourse to the new binary owners. Because of the full payout provision the binary holdings might well pay out more than five to nine times what is typically paid out today. Thus what was being proposed was a new widespread capital ownership to achieve a widespread income (thereby balancing supply and demand) and associated individual incomes which can be possessed by anybody in the population irrespective of whether or not that person is in a conventional job or not (Kelso & Hetter, 1967).

The “binary” (in ‘binary economics’) sometimes perplexes people. It means “composed of two” because it suffices to view the factors in production as being but two (labor and capital) and thus there are only two ways of genuinely earning a living ─ by labor or by the ownership of productive capital (Kelso & Kelso, 1991). In viewing the two factors it can also be observed that humans own their own labor but they do not necessarily own the other factor – capital.

Employee Stock Ownership Plans (ESOPs)

Very often the first acquaintance people have with binary economics comes through today’s Employee Stock Ownership Plans (ESOPs). These stem from a binary concept although it is important to understand that (the original concept having been implemented for the purposes of the old paradigm rather than the new binary one) present ESOPs are not true binary ESOPs. Among other things, they do not have full payout of earnings and – the key binary concept – do not make use of interest-free loans issued from the central bank and administered by the banking system (Kelso & Kelso, 1991).

It should be noted that the ESOP is only one several techniques which can be used to broaden capital ownership but all the techniques have at their heart the use of central bank-issued interest-free loans for the creation and spreading of productive capacity. Without those loans the primary defect in the present ESOP legislation will remain in that it requires poor and working people to acquire capital primarily with the present earnings of labor rather than primarily with the future earnings of capital.

Binary Economics Today

Over the last few years binary economics has been developing (Ashford & Shakespeare, 1999; Kurland, Brohawn & Greaney, 2004) and, in particular, making universal its appeal so that its essence is more easily understood around the world (Shakespeare & Challen, 2002). Whereas, for example, the uses of central bank-issued interest-free had been limited or under-developed, they now cover all the economy as long as the spreading of productive capacity is involved; whereas public capital and environmental capital were, relatively, neglected, they are now principal subjects; and whereas the first emphasis was on capital ownership it is now on the supply of interest-free loans for the spreading of productive capacity which can take many different forms (e.g., Turnbull, 2001). The emphasis on the interest-free loan supply is especially important for Islam (see Integrating Islamic Finance into Mainstream Shakespeare, 2006; Choudhury, 2007; Shakespeare, 2007).

But, most important of all, binary economics is now seen to be by far the most universal economics with the most efficiency and the most justice and, at the same time, it is an economics which corresponds deeply with core aspects of religious belief. For example, it has a concept of unicity embracing all aspects of life (Shakespeare, 2007). This resonates with Muslims (Tawhid); Christians (Kingdom (or Kin-dom) of God); Hindus, Buddhists, Jains and Sikhs (Dharma); and Jews (Shalom).

(Courtesy of the Mall Area Religious Council (MARC), Mall of America, Bloomington, USA) Hello Rodney :-)

Furthermore, binary economics now confidently embraces major elements from the present and the past. From the past come: –

- a prohibition of riba (interest)

- a strong ethical sense

- a sense of stewardship

- a demand for structural social and economic justice (as opposed to mere palliative charity).

From the present come key insights including: –

- money today is created out of nothing as debt on which riba/interest is imposed

- in respect of newly-created central bank loans which are lent interest-free for the spreading of productive or environmental capital purpose, riba/interest ─ as distinct from administrative and any other essential cost ─ is not merely wrong and debilitative of the economy and society but is not necessary

- the technological capacity exists to eliminate poverty and thus continuing poverty is the fault of human institutions and practices rather than of any inadequacy of equipment or expertise.

Past and present then come together to create a new economics, a new politics, a new social morality, a solution to the major problems of the environment and to deepen democracy. On the latter point, the political vote is far from enough. In a world where 25,000 people die each day from the effects of unclean water, a deepening of democracy requires not only the vote but also the proper provision of clean water, health services, housing, education and also some form of income, if only minimal, for all individuals.

Other consequences of binary economics include an end to economic colonialism, a diminution of the national debt; an improvement in the position of women and policy to unite differing groups.

Uses of Central Bank-issued Interest-free Loans for the Spreading of Productive Capacity

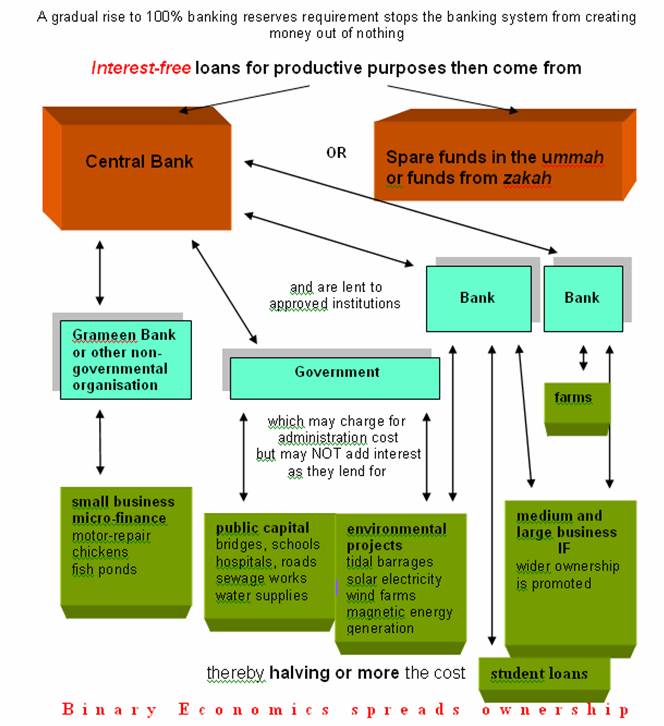

Binary economics proposes that central bank-issued interest-free loans should be administered by the banking system and that, while no interest would be charged, there would be an administrative cost (as well as capital credit insurance if necessary (Kelso & Adler, 1961). This supply of interest-free loans for the spreading of productive capacity as well as for environmental and public capital would take place in circumstances of (over time, on market principles) a move to 100% banking reserves so that the banking system would not be continually creating money (as happens today) but would be confined to lending (with permission) depositors’ money and the bank’s own capital.

The uses of the central bank-issued interest-free loans can be summarized as follows: –

- Public capital investment. This would allow hospitals, social housing, roads, bridges, sewage works, waterworks, schools etc. to be built for one half, or one third of the present cost. However, the capital projects can still, if wished, be built, managed, even owned, by the private sector.

- Private capital investment IF such investment creates new owners of capital and is part of national policy to enable all individuals, over time, on market principles, to become owners of substantial amounts of productive, income-producing capital. By using central bank-issued interest-free loans, a large company/corporation would get cheap money as long as new binary shareholders are created. The key point is that the cost, at the very least, is being halved while, at the same time, the ownership of productive capacity is being spread.

- “Green” environmental capital investment particularly for clean, renewable energy. At present, a lot of green technology projects are not financially viable. With interest-free loans, however, they would be. At last we would be able to have clean electricity through tidal barrages, wave machines, windmills, solar electricity, and geothermal power stations.

- Small and start-up businesses, microfinance and small farms thereby freeing them from the huge pressure of compounding interest-bearing debt.

- Loans to students. It is irresponsible – and unnecessary – to burden students with interest-bearing debt.

Flow of Interest-free Loans for the Spreading of Productive Capacity

A gradual rise to 100% banking reserves requirement stops the banking system from creating money out of nothing

Environment

Binary economics spreads productive (and the associated consuming) capacity so that all individuals in the population -- including babies, carers and those not normally in conventional employment -- have at least some form of secure, independent income. The income starts small and grows larger over time. This is essential if there is to be any hope of changing people's attitudes towards excessive consumption. At present virtually everyone has either had a scarring experience of poverty or has a perception or fear that they might fall into such poverty. In short, people feel insecure and that is one of the main factors in explaining greed. The insecurity -- and the associated aggressive consuming attitudes -- will only disappear if all people have material security and, at the same time, all people in some degree earn in exactly the same way as do others (i.e. at least part of their individual income should come through capital ownership). Only then will there be hope of people voluntarily minimising their greed.

Greed is also caused by the present financial system which creates sufficient money for the principal of interest-bearing loans to be repaid but does not create sufficient money with which to repay the interest. The result is that more interest-bearing money has to be created (with more inflation and more people going into debt) and more frenetic activity in the endeavour to try to make repayment (el-Diwany, 2003). Worse, the system favours the short term destruction of natural wealth rather than its long term maintenance. Unless the role of interest in the financial system is substantially diminished not only is the environment at risk but so is the stability of the world financial system .

It is also the case that populations only stabilise when there is a reasonable standard of living, good education and health and at least some status for women. Binary economics provides these things and is essential if the present growth of the world's population is to be moderated.

Lastly, there is now an extraordinary range of 'alternative' green technologies capable of generating clean electricity but which cannot be used because, in the present system of interest-bearing money, they are not financially viable. With interest-free loans, however, they will become viable.

Productiveness

Students of binary economics may wish to be briefly introduced to an important binary concept – productiveness. Binary productiveness and conventional productivity are completely different animals.

Conventional productivity, in the conventional classical and neo-classical sense, is the ratio of labor as input to the overall output. As a mathematical fraction, it is output divided by human input.

In contrast, binary productiveness is the percentage of total input that labor and capital each contributes to the output. In binary economics, labor and capital are viewed as being of a different, although co-operating, nature and therefore should be seen as separate inputs contributing to output. Capital contributes an increasing percentage as even Marx understood -- Kelso 1957. For example, a man digging a hole with his hands only will take three hours. But, by using a form of capital ─ a shovel ─ he can dig the hole in one hour or dig three holes in the same amount of time it took him to dig one hole with his hands. The productiveness of the human labor is 25% while the productiveness of the capital shovel is 75%. Together, of course, man and shovel ─ labour and capital ─ produce much more than they would produce separately.

Where binary productiveness is concerned, it is also useful to consider the examples of an automated factory or a huge dam producing electricity and fresh water. In the case of the automated factory there is minimal or no human input (the work involved in design and building is over and has received its payment, and maintenance and repair are only maintenance and repair rather than a direct contribution to production).

In the case of the dam, with relatively little human input although it is critical, the physical output of the capital is huge and binary economics views the sun, weather and gravity as greatly contributing to the production. The latter are co-operating capital assets even if they are ones which cannot be owned.

Selected External Links

- Center for Economic and Social Justice

- Global Justice Movement Net

- Global Justice Movement Org

- Integrating Islamic Finance into Mainstream

- Binary Economics - An Overview by Professor Robert Ashford

- The Binary Alternative & The Future of Capitalism

- The Binary Economics of Louis Kelso

- http://ssrn.com/abstract=277508

- http://www.cesj.org/binaryeconomics/price-money.html

- http://cog.kent.edu/lib/TurnbullBook/TurnbullBook.htm

- Capital Democratization

Selected Texts

- Ashford, Robert The Binary Economics of Louis Kelso, (Rutgers Law Journal, vol. 22. 1990).

- Ashford, Robert Louis Kelso’s Binary Economy (The Journal of Socio-Economics, vol. 25, 1996).

- Ashford, Robert & Shakespeare, Rodney (1999) Binary Economics the new paradigm.

- Choudhury, Masudul Alam (2007) The Universal Paradigm and Islamic World-system. Economy, Society, Ethics and Science. Preface by Rodney Shakespeare.

- el-Diwany, Tarek (2003) The Problem With Interest.

- Gauche, Jerry Binary Modes for the Privatization of Public Assets, (The Journal of Socio-Economics. Vol. 27, 1998).

- Greenfield, Sidney M. Making Another World Possible: the Torah, Louis Kelso and the Problem of Poverty (paper given at conference, Colombia University, May, 2006).

- Kelso, Louis & Kelso, Patricia Hetter (1986 & 1991), Democracy and Economic Power.

- Kelso, Louis & Adler, Mortimer (1958), The Capitalist Manifesto.

- Kelso, Louis & Adler, Mortimer (1961), The New Capitalists.

- Kelso, Louis & Hetter, Patricia (1967), Two-Factor Theory: the Economics of Reality.

- Kelso, Louis (1957), Karl Marx: The Almost Capitalist (American Bar Association Journal, March, 1957)

- Kurland, Norman The Federal Reserve Discount Window (Winter 1998, Journal of Employee Ownership Law and Finance).

- Kurland, Norman A New Look at Prices and Money: The Kelsonian Binary Model for Achieving Rapid Growth Without Inflation.

- Kurland, Norman; Brohawn, Dawn & Michael Greaney (2004) Capital Homesteading for Every Citizen: A Just Free Market Solution for Saving Social Security.

- Miller, J.H. ed., (1994), Curing World Poverty: The New Role of Property.

- Reiners, Mark Douglas, The Binary Alternative and Future of Capitalism.

- Roth, Timothy P. (1996). A Supply-Sider's (Sympathetic) View of Binary Economics. Journal of Socio-Economics 25 (1): 55–68.

- Shakespeare, Rodney & Challen, Peter (2002) Seven Steps to Justice.

- Shakespeare, Rodney, Integrating Islamic Finance into the Mainstream (paper delivered at Harvard, April, 2006)

- Shakespeare, Rodney (2007) The Modern Universal Paradigm.

- Shakespeare, Rodney & Proudfoot, Wilf (1976) The Two-factor Nation.

- Turnbull, Shann (2001) The Use of Central Banks to Spread Ownership.

- Turnbull, Shann (1975/2000), Democratising the Wealth of Nations.